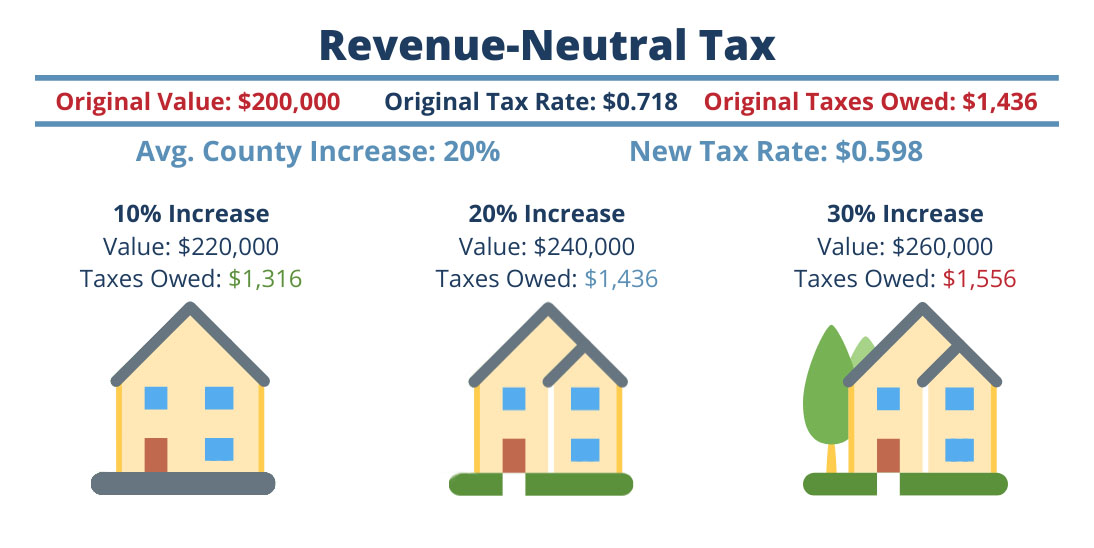

Wake County Property Tax Rate 2024 Increase Size – While it’s very likely Wake County homeowners’ homes will increase property tax In 2024, it would be worth $300,000 with a $1,393 property tax In the same time, because of the lowering tax . The Wake County Board of Commissioners got its first look at the 2024 revaluation keep their revenue-neutral rates, people will likely experience a property tax increase. .

Wake County Property Tax Rate 2024 Increase Size

Source : www.wake.gov

Wake County unanimously passes $1.8 billion budget, property tax

Source : www.wral.com

Some Wake Residents Could Save $ If The County Goes Revenue Neutral

Source : www.johnlocke.org

Wake County unanimously passes $1.8 billion budget, property tax

Source : www.wral.com

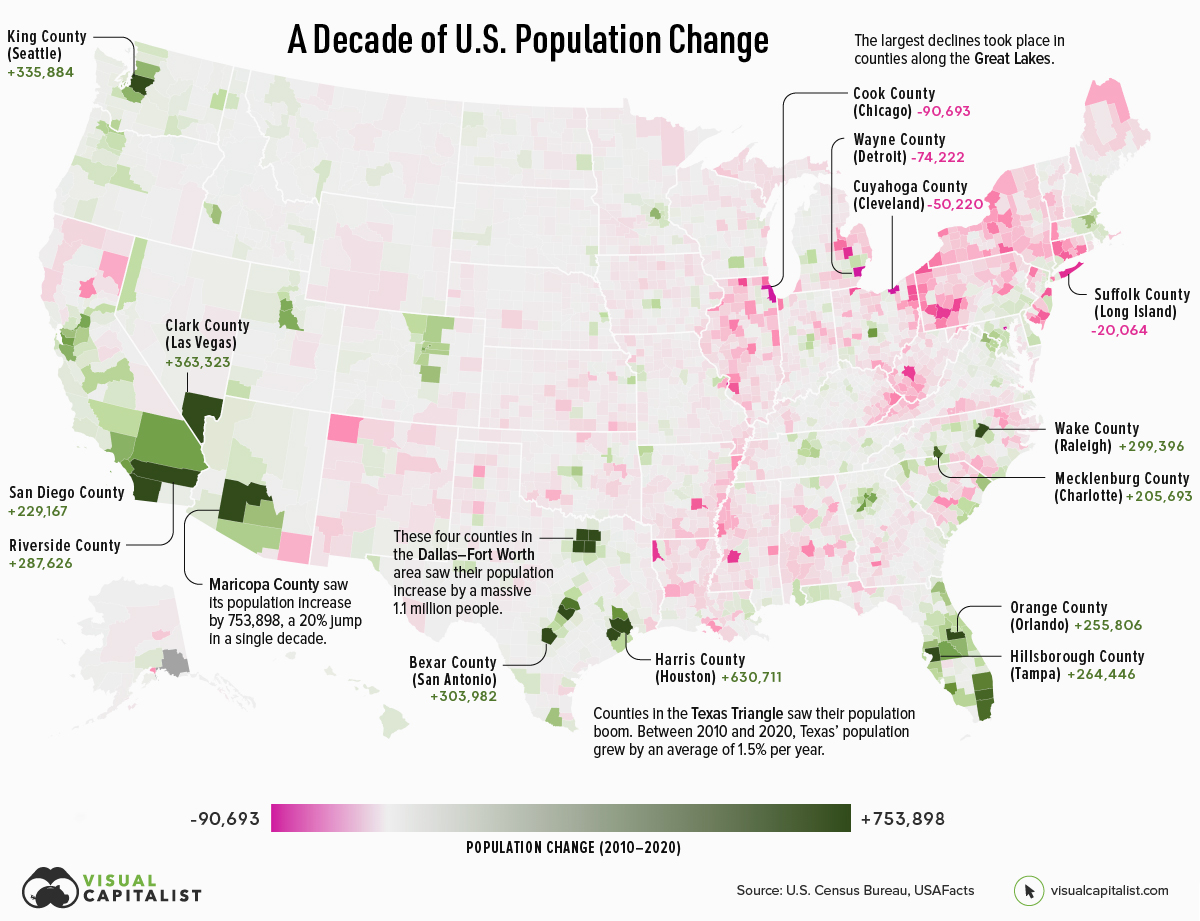

Mapped: A Decade of Population Growth and Decline in U.S. Counties

Source : www.visualcapitalist.com

Wake County homeowners brace for property tax adjustments: What to

Source : www.wral.com

Expert on how to appeal rising property values in Wake County

Source : www.cbs17.com

1 Wake County Public School System Superintendent’s Proposed

Source : www.wcpss.net

Expert on how to appeal rising property values in Wake County

Source : www.cbs17.com

Town of Wendell

Source : www.facebook.com

Wake County Property Tax Rate 2024 Increase Size Fiscal Year 2024 Adopted Budget | Wake County Government: Wake County’s 2024 revaluation, the process of updating real property values to reflect fair market value as of Jan. 1, shows an overall increase a revenue-neutral tax rate. . Call it a “WAKE-UP” call and all over social media, people were upset and flustered to see how much the value of their property has increased since the last valuation in 2020. The average residential .