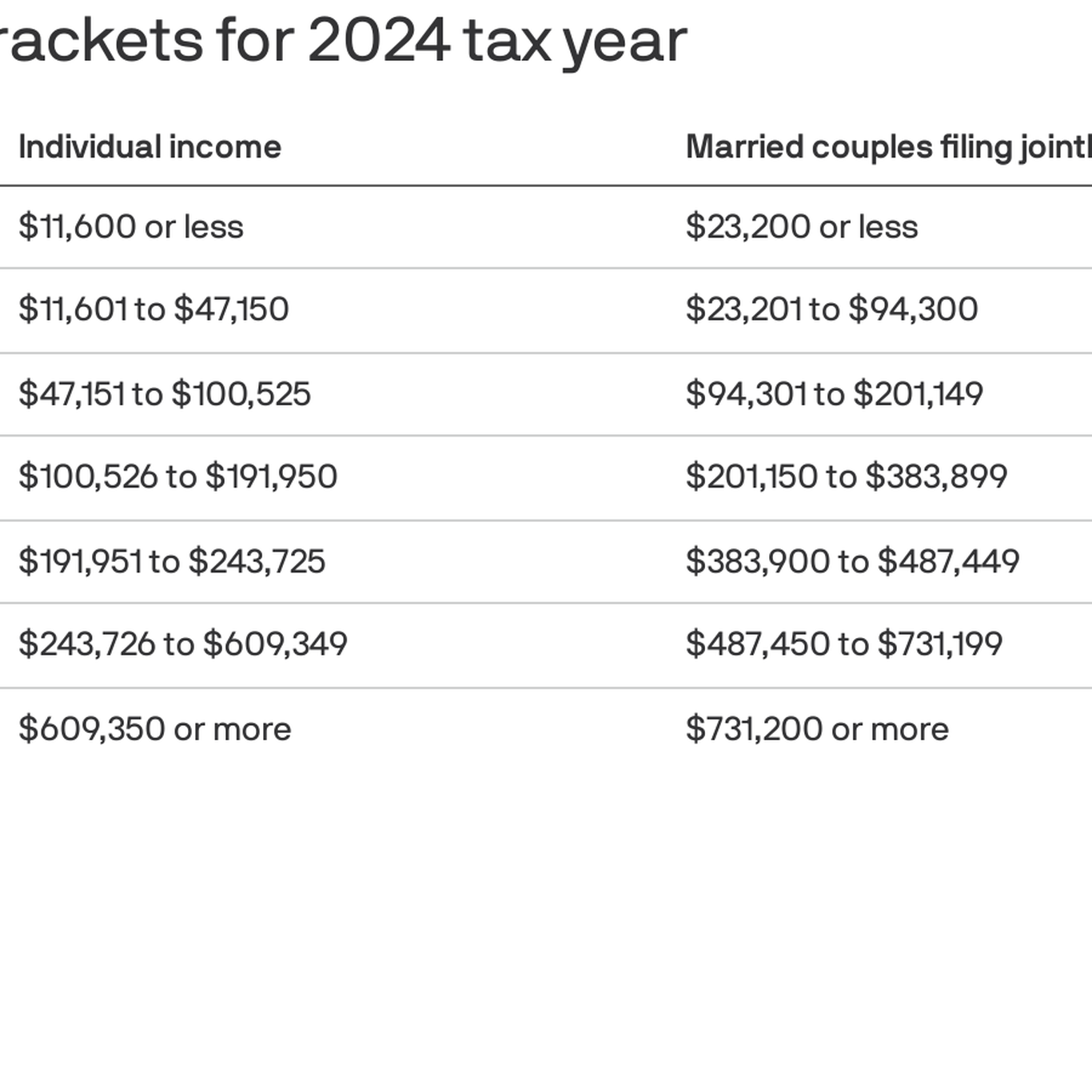

2024 Tax Bracket Irs – The IRS raised the income cutoffs for each tax bracket by an average of 5.4%, allowing you to keep more of your money . There are seven federal income tax rates for 2023 and 2024: 10%, 12%, 22%, 24%, 32%, 35% and 37%, depending on your taxable income and filing status. .

2024 Tax Bracket Irs

Source : www.cnbc.com

Americans will take home more income as IRS changes tax brackets

Source : www.actionnewsjax.com

IRS announced new tax brackets for 2024—here’s what to know

Source : www.cnbc.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

2024 tax brackets: IRS inflation adjustments to boost paychecks

Source : www.axios.com

Projected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.com

IRS: Here are the new income tax brackets for 2024

Source : www.cnbc.com

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

JUST IN: The IRS has announced higher tax brackets for 2024

Source : www.reddit.com

IRS raises tax brackets, see new standard deductions for 2024

Source : www.usatoday.com

2024 Tax Bracket Irs IRS: Here are the new income tax brackets for 2024: Here’s how to do it. The IRS has already released tax brackets for 2024, the taxes you will file in 2025. For the top individual tax bracket, the 2024 income threshold was raised from $578,126 to $609 . The IRS in November unveiled the federal income tax brackets for 2024, with earnings thresholds for each tier adjusting by about 5.4% higher for inflation. While it’s lower than the tax bracket .

:quality(70)/d1hfln2sfez66z.cloudfront.net/01-04-2024/t_903e8050a8c34db8af3dc5d275738e8d_name_file_960x540_1200_v3_1_.jpg)